Note: For information about Advertising payments, see Payments in Ad Exchange.

What payment methods does Sovrn offer?

-

Direct Deposit/ACH.

-

Check.

-

PayPal. Check to see if PayPal is supported in your country here.

What are payment thresholds?

The payment thresholds for Sovrn Commerce are $50 for wire transfers, and $25 for all other payment types (ACH, Check, eCheck and PayPal).

How do I set up my payment options?

Sovrn Commerce payment options are available in our self - serve platform. This allows our publishers to have full access to make any payment updates when needed.

There are a few steps that must be completed in your account in order to ensure it is setup for your first payment.

-

Login and navigate to the Payment page in the Platform.

-

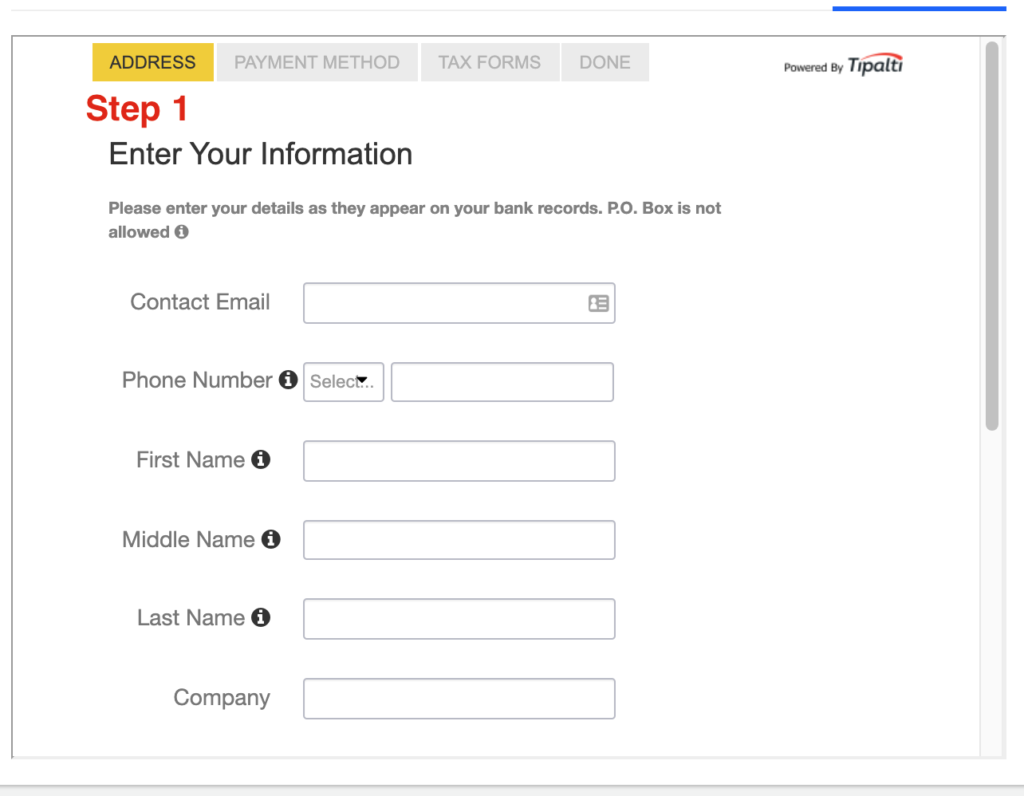

Then, fill out the information you see there:

-

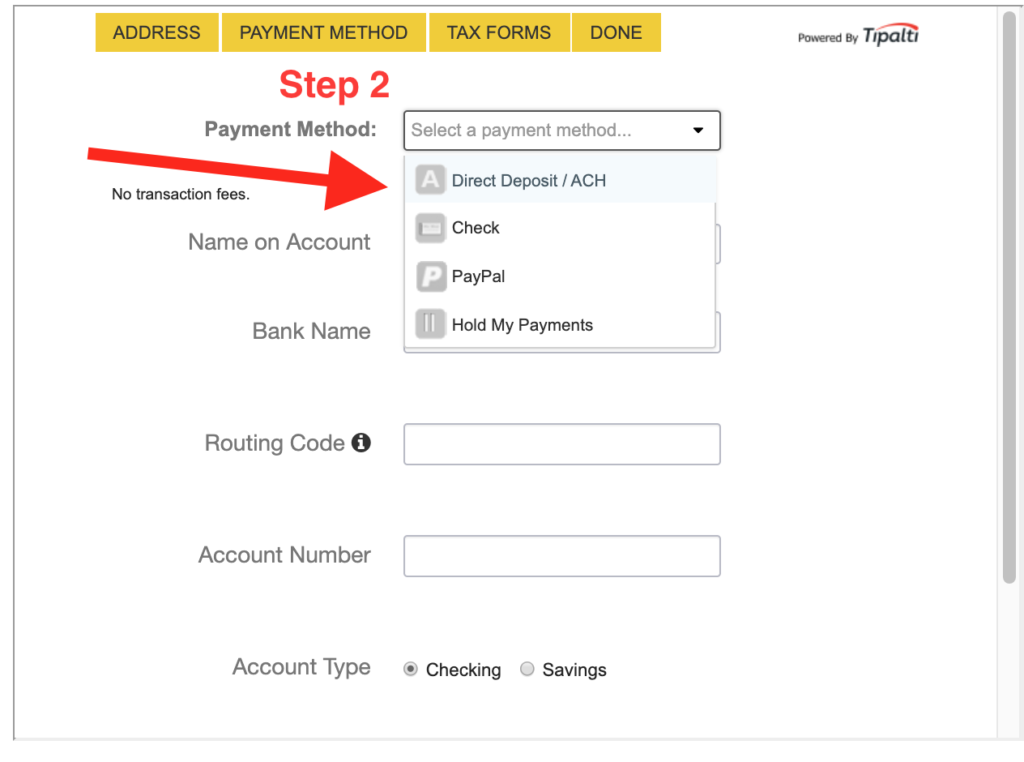

Next is to complete your desired payment method. Our available options are:

-

Direct Deposit/ACH

-

Check

-

PayPal

-

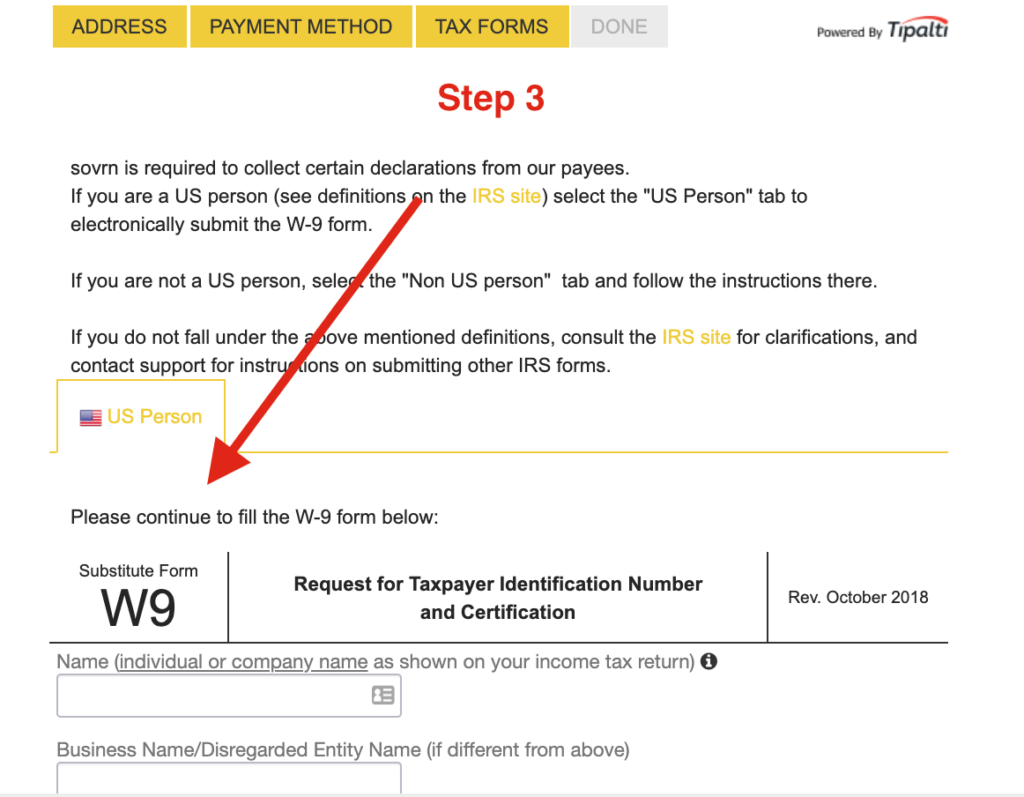

Last detail to complete is tax information. This will ensure we have all this information up to date at the time these documents are issued each year.

Then you are all set!

When will I receive my payment?

Sovrn Commerce pays publishers 90 days from the end of the month in which commissions were earned. For example, commissions earned in January will be paid out at the end of April.

The payment thresholds for issuance are $50 for Wire Transfers and $25 for ACH, Check, eCheck and PayPal. If your earnings do not exceed these thresholds, unpaid earnings will roll into each subsequent month's earnings until they exceed the payment thresholds.

There are no fees involved. Sovrn Commerce pays all PayPal, ACH, and postage fees. Your bank may charge you a fee on international wire transfers. You can check with your bank to see exactly what that charge will be.

Sovrn Commerce's Payment Settings can be accessed in your account here and clicking the “Commerce” selection under the “Product” dropdown menu.

Why didn't I get paid the amount I expected?

The most likely reason for this is due to adjustments or reversals. Adjustments can occur anytime. In order to account for them in previous monthly earnings, Sovrn Commerce always pays based on lifetime earnings and previous payments.

The most common adjustments to publisher earnings are related to sales returns or late revenue approvals by the merchant, causing previous earnings to either increase or decrease depending on the circumstance.

Most adjustments occur within 2-3 months after the month of earning, but they can happen at any time.

Certain verticals tend to see adjustments later than others, such as travel. Many affiliate programs for travel merchants are confirmed upon trip completion instead of booking date. If a commission was earned for a hotel stay in 4 months, it leaves a longer window for a commission to be adjusted.

Reversals happen for several reasons:

-

If the item(s) sold were returned back to the merchant.

-

If the transaction was canceled or rejected by the merchant.

-

At network/merchant discretion because they believe the transaction is not legitimate.

Revenue never technically locks, although it is almost always finalized by the time payments are issued on the net-90 schedule.

Why didn't I receive payment?

If you never received a payment, there could be a couple of reasons why:

-

Your account is less than 90 days old. We pay on a net-90 basis, so if you've earned a commission in your first month, you'll receive that amount 90-days later. For example: if you signed up in January and earned a commission in January (more than $25), then this amount will be paid at the end of April.

-

You have not earned at least $25. Our minimum payout threshold is $25. If this amount isn't met, instead of receiving a payment we will roll over those earnings to the next month or until you've reached the minimum $25.

-

Your PayPal is not set up correctly. Please make sure your PayPal email is registered to the correct email you have listed on our payment page. If the address is correct, please log in to PayPal to claim the payment.

-

Your Check/eCheck/ACH/Wire is not set up correctly. Please confirm with your bank if you have not received an ACH or Wire payment. If you are paid via check, ensure that your address is correct. Note that international checks can take weeks to deliver.

-

Your account has been placed on a Network Quality payment hold until we can resolve any issues raised by merchants in our network. You will be notified immediately by our Network Quality team should a hold be placed on your account.

How can I reconcile my payments and earnings?

Due to the large number of publishers in Sovrn Commerce's network, earnings-to-payment reconciliations are not created and issued to publishers on a monthly basis.

To track your payments relative to earnings, please log in to your Publisher Dashboard. There you will find your earnings for each month. From there, you can compare your aggregate earnings history (excluding months that are within the last 90 days from today's date) to your payment history over the same period from each of the payment options you have designated in your time as a Sovrn Commerce publisher (PayPal, check, ACH, wire). Please note that earnings may fluctuate or be held back due to merchant policies (i.e. traffic deemed illegitimate, product returns, etc.). These adjusted earnings will be reflected in the calculation of each month's earnings.

Who is responsible for exchange fees and bank fees?

Sovrn covers any currency exchange fees that are required to send the payment, but banks might charge additional fees. Publishers should always contact their banks first with questions about payments received.

What currency does Sovrn pay in and can I get paid in a different one?

By default Sovrn pays in USD, but this setting can be changed. Payment currency options are driven by the selected payment method - publishers can get paid in a different currency if they select "Wire Transfer" as their payment method.

Will I Receive a 1099?

Not all Sovrn publishers will receive a 1099 report for tax purposes.

Below is some general information and some of the qualifiers to receive a 1099 from Sovrn. Keep in mind there may be other qualifiers, but the main things to consider are below. If you do not meet the criteria specifically for the previous tax year, you will not receive a 1099 from Sovrn.

-

If you were paid less than $600 in the previous tax year: You will not receive a 1099 report.

-

If you were paid via PayPal: You will receive your tax documents from PayPal, not from Sovrn. Check the PayPal Help Center to find out more.

-

If you were paid more than $600 in the previous tax year AND you are not paid via PayPal AND you are filing taxes as an individual, partnership, trust or LLC-partnership: You will receive a 1099 from Sovrn in the mail.

Per IRS guidelines, 1099s are mailed out by January 31st.

Please note: you are obligated to report income you receive, whether or not that income is reported on a Form 1099 or another tax report. Sovrn is not able to provide you with any tax advice and we recommend that you consult your own tax advisor.

Please reach out to Support if you feel that you qualified for a 1099 and did not receive it, or have any questions about whether you qualify to receive one.

Need More Help?

Please contact us at support@sovrn.com